searchconsole.ru

Gainers & Losers

What Mutual Funds To Buy

Fidelity's FundsNetwork allows you to invest in mutual funds from hundreds of fund companies outside of Fidelity, including many available with no transaction. One often-overlooked option is to buy mutual funds directly through the investment companies that offer and manage them. Mutual fund companies range from. Top performing low-fee mutual funds in · Fidelity Blue Chip Growth (FBGRX) · Shelton Nasdaq Index Investor (NASDX) · Victory Nasdaq Index (USNQX). Mutual funds are a managed portfolio of investments that pools money together with other investors to purchase a collection of stocks, bonds. Summary: Best Mutual Funds · Fidelity International Index Fund (FSPSX) · Fidelity U.S. Sustainability Index Fund (FITLX) · Schwab S&P Index Fund (SWPPX). Thousands of mutual funds offered from hundreds of mutual fund companies made available through Fidelity Investments. Discover mutual funds: pooled assets investing in stocks, bonds, and securities. Build your legacy with high-quality, low-cost mutual funds from Vanguard. Merrill Edge Select™ Funds. The Merrill screening process takes the guesswork out of finding quality funds for investors with a self-directed account. Taking. Find the right mutual funds for your portfolio. Schwab offers the tools to research, compare and invest in mutual funds all in one place. Fidelity's FundsNetwork allows you to invest in mutual funds from hundreds of fund companies outside of Fidelity, including many available with no transaction. One often-overlooked option is to buy mutual funds directly through the investment companies that offer and manage them. Mutual fund companies range from. Top performing low-fee mutual funds in · Fidelity Blue Chip Growth (FBGRX) · Shelton Nasdaq Index Investor (NASDX) · Victory Nasdaq Index (USNQX). Mutual funds are a managed portfolio of investments that pools money together with other investors to purchase a collection of stocks, bonds. Summary: Best Mutual Funds · Fidelity International Index Fund (FSPSX) · Fidelity U.S. Sustainability Index Fund (FITLX) · Schwab S&P Index Fund (SWPPX). Thousands of mutual funds offered from hundreds of mutual fund companies made available through Fidelity Investments. Discover mutual funds: pooled assets investing in stocks, bonds, and securities. Build your legacy with high-quality, low-cost mutual funds from Vanguard. Merrill Edge Select™ Funds. The Merrill screening process takes the guesswork out of finding quality funds for investors with a self-directed account. Taking. Find the right mutual funds for your portfolio. Schwab offers the tools to research, compare and invest in mutual funds all in one place.

This brochure explains the basics of mutual fund and ETF investing, how each investment option works, the potential costs associated with each option, and how. Mutual funds are defined as a portfolio of investments funded by all the investors who have purchased shares in the fund. So, when an individual buys shares in. Growth – Designed to produce the highest long-term results, these funds usually maximize capital appreciation with little to no income for the investor. Top 25 Mutual Funds ; 1, VSMPX · Vanguard Total Stock Market Index Fund;Institutional Plus ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index. Popular Fund Families · iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century. Top performing low-fee mutual funds in · Fidelity Blue Chip Growth (FBGRX) · Shelton Nasdaq Index Investor (NASDX) · Victory Nasdaq Index (USNQX). TIAA has featured mutual funds which allows you to invest in a collection of stocks, bonds, international funds and multi assets. See how to get started. I have about $14k in my account so far and just got into FSELX. Should I put it all in there or also invest in some other funds like FSPTX. A mutual fund is a managed portfolio of investments that investors can purchase shares of. Mutual fund managers pools money from many investors. Though a myriad of different investment websites-cum-trading platforms exists, there are three basic ways to purchase mutual funds online. Our pick for the best overall mutual fund is Fidelity Index Fund (FXAIX). With an expense ratio of just %, this fund ranks as one of the cheapest in. Investors buy mutual fund shares from the fund itself or through a broker for the fund, rather than from other investors. The price that investors pay for the. Both are less risky than investing in individual stocks & bonds. Check out the list of the best mutual funds to invest in in India and start investing online for free without any hassle at ET Money. What are the potential benefits of investing in mutual funds? Because mutual funds can invest in many different stocks or bonds, they give investors an easy. One of the key distinguishing features of a mutual fund is that investors can buy and sell shares at any time. The fund will create new shares to meet increased. Mutual funds work by pooling money from multiple investors to purchase stocks, bonds and other securities. Because they draw from a collection of companies. Information and resources from the Washington Department of Financial Institutions. Mutual funds let you pool your money with other investors to "mutually" buy stocks, bonds, and other investments. They're run by professional money managers. At Wells Fargo, you can invest in funds directly, through a brokerage account, or through an experienced financial professional.

Hellofresh Plan Prices

HelloFresh's most popular plan size is 3 weekly recipes for 2 people. This works out to $ per serving or about $60 per week, plus the cost of shipping. The meals start as low as $ per meal. This is similar, if not less expensive, than similar meal kit delivery services on the market today. HelloFresh. Let HelloFresh take the meal planning and grocery shopping off your plate. *Applied as discount across 7 boxes, new subscriptions only, and varies by plan. Try Cherrypick for free today. Plan meals & shop them instantly. Free personalised recipes. No subscriptions. Supermarket prices. Classic Plans ; Plan / Company. Price for 1 person . Price for 2 people ; Woop's "Classic". N/A. N/A ; HelloFresh (recipes with no special label). N/A. $ -. Individual meals cost between $$/serving, with a standard $ for shipping. There is no membership fee. Plan. Dinner for 2 (2 meals per week). The lowest price per serving you'll find is $, but you'll only pay that if you sign up to receive at least 6 meals per week for 4 people. The price per. The cost of HelloFresh. At between $ and $ a serving, HelloFresh's prices are about average for meal kit companies. But the average for meal kit. Each box varied in price, mine ranged from $$ Each includes a $5 shipping fee. What wasn't super clear is that after I paid for my free trial plus $5. HelloFresh's most popular plan size is 3 weekly recipes for 2 people. This works out to $ per serving or about $60 per week, plus the cost of shipping. The meals start as low as $ per meal. This is similar, if not less expensive, than similar meal kit delivery services on the market today. HelloFresh. Let HelloFresh take the meal planning and grocery shopping off your plate. *Applied as discount across 7 boxes, new subscriptions only, and varies by plan. Try Cherrypick for free today. Plan meals & shop them instantly. Free personalised recipes. No subscriptions. Supermarket prices. Classic Plans ; Plan / Company. Price for 1 person . Price for 2 people ; Woop's "Classic". N/A. N/A ; HelloFresh (recipes with no special label). N/A. $ -. Individual meals cost between $$/serving, with a standard $ for shipping. There is no membership fee. Plan. Dinner for 2 (2 meals per week). The lowest price per serving you'll find is $, but you'll only pay that if you sign up to receive at least 6 meals per week for 4 people. The price per. The cost of HelloFresh. At between $ and $ a serving, HelloFresh's prices are about average for meal kit companies. But the average for meal kit. Each box varied in price, mine ranged from $$ Each includes a $5 shipping fee. What wasn't super clear is that after I paid for my free trial plus $5.

Eating vegetarian food that doesn't cost you time and money may feel impossible, but it doesn't have to. With a HelloFresh vegetarian weekly meal plan, you can. MoneyHub users get up to $ off 5 boxes (valid on all Classic, Family, Veggie & Calorie Smart plans). The price of the box remains the same, unless you change. price of ingredients. By making the jump from a simple delivery to a well thought through recurring meal plan, HelloFresh is a clear example of theServices. Plan” for recipes that children tend to love. You can also upgrade your purchase at PM ET. Discount varies for other meal plans and sizes. One free breakfast item per box with an active subscription. Applied as a discount across 7 boxes, new subscribers only, varies by plan. Each box varied in price, mine ranged from $$ Each includes a $5 shipping fee. What wasn't super clear is that after I paid for my free trial plus $5. HelloFresh is a well-known meal-kit delivery service. When you sign up, you choose a plan with the number of meals and portions you want each week. How Much Does HelloFresh Cost? HelloFresh bases its pricing on the number of people included in the plan and the number of meals each person receives. For two. The standard upcharge on all plans is $ per serving. Again, perfect for dates and impressing literally anyone. Trying out these meals just may have been the. The cost of HelloFresh. At between $ and $ a serving, HelloFresh's prices are about average for meal kit companies. But the average for meal kit. *Applied as discount across 7 boxes, new subscriptions only, and varies by plan. cost than your local restaurant. With HelloFresh, you get a meal. How Much Does HelloFresh Cost? · 2 People, 3 Recipes Per Week: 6 Meals – £30 (£5 Per Serving) · 2 People, 4 Recipes Per Week: 8 Meals – £ (£ Per Serving). HelloFresh has a starting price of $ per serving if you order the maximum number of servings per week (and use our current code). Hungryroot's prices also. How much does HelloFresh cost? For Family Friendly plans, four meals for four people in a week would be $ or about $ per serving (depending on the. For our 2-person plan, meal kits start at $ per serving for 3, 4, and 5 meals a week. For our 4-person plan, meals start at a reduced price of $ per. Meal Plan Options · $ per serving for two people wanting three, four, or five recipes per week · $ per serving for four people wanting four or fives. Hello Fresh offers three basic plans: the Classic Plan, the Veggie Plan, and the Family Plan. The Classic and Veggie Plans are priced at $ per serving. On top of these costs, you need to pay the aforementioned $ delivery plus the cost of any additional special meals, sides, ready meals or snacks that you've. HelloFresh will take your first selection as your custom plan, but you can change this week to week. Ingredients are, true to the name, fresh and high quality.

Best Free Hours Tracker App

![]()

Hours Tracker: Time Tracking 4+. Work Clock In Pay Calculator. Cribasoft, LLC. Designed for iPhone. Open Time Clock is an online free time clock software, time tracking app that manages employee time & attendance for payroll processing & client project. Clockify is a time tracker and timesheet app that lets you track work hours across projects. Unlimited users, free forever. Easily track your time and earnings for one or more jobs. Clock in and clock out as you work or enter start and stop times yourself. HoursTracker groups your. The Best employee time tracking Android apps comparison ; Toggl. A simple (yet powerful) time tracker that helps you learn how much your time is worth. Free for. Our Top Tested Picks · BQE Core · TSheets · Zoho Projects · Hubstaff · Time Doctor · VeriClock · Wrike · Mavenlink. The world's best time tracking software. Track employee time, send beautiful client reports, and calculate profitability. Free and paid plans to save you. Hubstaff - A good mix of time tracking and employee monitoring features. RescueTime - Another option that is often mentioned in similar lists, but its user. Check the 20 best employee time tracking software & apps with in-depth comparison. Use Apploye, the best time tracking app for your employees. Hours Tracker: Time Tracking 4+. Work Clock In Pay Calculator. Cribasoft, LLC. Designed for iPhone. Open Time Clock is an online free time clock software, time tracking app that manages employee time & attendance for payroll processing & client project. Clockify is a time tracker and timesheet app that lets you track work hours across projects. Unlimited users, free forever. Easily track your time and earnings for one or more jobs. Clock in and clock out as you work or enter start and stop times yourself. HoursTracker groups your. The Best employee time tracking Android apps comparison ; Toggl. A simple (yet powerful) time tracker that helps you learn how much your time is worth. Free for. Our Top Tested Picks · BQE Core · TSheets · Zoho Projects · Hubstaff · Time Doctor · VeriClock · Wrike · Mavenlink. The world's best time tracking software. Track employee time, send beautiful client reports, and calculate profitability. Free and paid plans to save you. Hubstaff - A good mix of time tracking and employee monitoring features. RescueTime - Another option that is often mentioned in similar lists, but its user. Check the 20 best employee time tracking software & apps with in-depth comparison. Use Apploye, the best time tracking app for your employees.

You could choose one of the basic free time tracking apps on the market best time tracker app of your choice. For instance, if getting started with. actiTIME is the best free time tracker app for individuals and teams. It has multiple time tracking options. First of all, you get an online timesheet. The DOL-Timesheet App helps track regular work hours, break time, and overtime hours. The new version of the app also enhances the comments capability. Use Apploye, the best time tracking app & software for desk, mobile, and remote employees to track time across projects. Available across web, desktop. Best FREE time tracking tool for agencies and freelancers. Unlimited team members, projects & workspaces. Absolutely Free. Jibble allows you to track hours by activity, project or client, ideal for billing and to help you understand where those hours are going. Get mobile with our best time tracker app · Free with every Time Tracker account! · Best time tracking app for iOS and Android devices: Track your time with ease. Simple Time Tracker helps you track how much time you spend during the day on different activities. Start new activities with one click. TimeCamp is a simple, yet feature-rich time tracking app to help you gain insights into yourprojects and tasks. How about giving a try to ProofHub, best time tracking and management software for small to large teams and businesses worldwide. It offers one. Easily track your time and earnings, whether you're an hourly employee, a contractor, or you just want to better manage your working hours. Connecteam – Best all-in-one employee time tracking app; Jibble – Good for project time tracking; QuickBooks Time – Good for customizable payroll reports; Toggl. Clockify is an excellent tool for both freelancers and full-time employees — it creates weekly reports with billable hours, provides a complete rundown of your. Traqq is great for agencies with remote employees. Teams big or small can track time and create reports. Traqq's free plan is the best for tracking. Track time and attendance seamlessly in a single time tracking app. With a physical time tracker, automatic time tracking, and other smart methods, you will do. My time tracking app of choice is Freelo. It is a Project management tool with a great built-in time tracker that helps me monitor the amount of. Jibble takes the headache out of time tracking. The team can easily see who's working at any given time and pull hours for reports and payroll. Overall, TimeCamp is one of the best time tracking apps on the market – it helps teams optimize their time usage and improve productivity. This time tracker app. Free Time Tracking software with a track record. Easily create shareable reports for your clients or managers, set hourly rates and generate invoices. Free time tracker app · Free time tracker. Quidlo Timesheets is free with full time tracker functionality for teams of up to 10 people. · Track time wherever you.

Best Priced Auto Insurance

Auto-Owners offers the lowest average premium for minimum coverage of the companies we reviewed. While it's not available in all states, Auto-Owners is highly. How do I find the cheapest auto insurance rates? searchconsole.ru makes it Getting the best auto insurance policy isn't just about the lowest price. The cheapest car insurance rates start at $39 per month and the most affordable companies with nationwide availability are USAA, Travelers, and Geico. California's Low Cost Auto (CLCA) Insurance Program is a state-sponsored program that makes insurance affordable for California residents who meet the. Companies like Geico, State Farm, and Progressive often come up in searches for cost-effective options because they offer plans that can be. Discover the most affordable car insurance quotes in Georgia with Velox Insurance. Easily compare the lowest rates and purchase your policy online today. Our data indicated USAA, GEICO and Nationwide were the cheapest insurance companies in auto insurance quotes. With us you get the cheapest auto insurance quotes from top rated U.S. automobile insurance companies. WE DO THE HARD WORK FOR YOU. Geico is the only one where you can get your car fixed within a few weeks, all the other big ones like progressive or state farm take months to. Auto-Owners offers the lowest average premium for minimum coverage of the companies we reviewed. While it's not available in all states, Auto-Owners is highly. How do I find the cheapest auto insurance rates? searchconsole.ru makes it Getting the best auto insurance policy isn't just about the lowest price. The cheapest car insurance rates start at $39 per month and the most affordable companies with nationwide availability are USAA, Travelers, and Geico. California's Low Cost Auto (CLCA) Insurance Program is a state-sponsored program that makes insurance affordable for California residents who meet the. Companies like Geico, State Farm, and Progressive often come up in searches for cost-effective options because they offer plans that can be. Discover the most affordable car insurance quotes in Georgia with Velox Insurance. Easily compare the lowest rates and purchase your policy online today. Our data indicated USAA, GEICO and Nationwide were the cheapest insurance companies in auto insurance quotes. With us you get the cheapest auto insurance quotes from top rated U.S. automobile insurance companies. WE DO THE HARD WORK FOR YOU. Geico is the only one where you can get your car fixed within a few weeks, all the other big ones like progressive or state farm take months to.

Houston, TX Car Insurance. Compare Progressive, Allstate, GEICO and Nationwide (+ other top companies) to find the best and cheapest car insurance in Houston. Country Financial has the cheapest car insurance for most good drivers in Georgia. Drivers who have never had an accident or received a citation are considered. Switch to Progressive and save · Allstate customers who switch and save with Progressive save $ on average · GEICO customers who switch and save with. In Arizona, the cheapest rates for bundling home and car insurance are from State Farm. In addition, Travelers offers the best auto insurance rates after. GEICO offers affordable car insurance by offering competitive rates and discounts nationwide. Depending on your location, you can tap into discounts for. Provides income eligible, good drivers access to state minimum liability insurance. Qualify and find an agent online. Cheapest Auto Insurance in Colorado (). State Farm offers the cheapest These insurers have the best prices in the state for liability-only insurance, of. State Farm has the cheapest car insurance for most good drivers in Texas. · Full coverage refers to a policy that goes beyond the minimum state requirements. USAA and Erie have the cheapest minimum liability car insurance rates, on average. This type of coverage will help you meet state liability insurance. If your car insurance bill has you discouraged, there's good news: shopping around, practicing defensive driving and identifying the best discounts for your. The cheapest car insurance company by driving record: Auto-Owners ; USAA. $ $ ; Geico. $ $ ; Amica. $ $ ; State Farm. $ $1, Shopping for auto insurance in North Carolina? Keep reading to learn about how much car insurance you'll need and ways to find the cheapest car insurance in. Pay-in-Full Discount. Save Hundreds by Switching to Mercury Insurance. We're devoted to keeping your auto insurance rate low. Find cheap car insurance rates from The General®. Get a car insurance quote today and find affordable insurance coverage for your driving needs. Pay-in-Full Discount. Save Hundreds by Switching to Mercury Insurance. At Mercury, we're committed to keeping your auto insurance rate low. Our insurance. Get a cheap car insurance quote from Nationwide and learn how you can find affordable auto coverage you can depend on Everybody wants the best value for their. low priced car insurance. We looked at the average car To find the best affordable auto insurance rates in other U.S. states, read our articles below. American Auto Insurance is an A+ rated Chicago auto insurance agency providing low-cost car insurance and SR insurance to all Illinois drivers. cheapest car insurance rate that will match your coverage needs. Commonly asked Does the best auto insurance rate guarantee the best coverage? Not. Auto-Owners is the cheapest option for Tucson drivers, and it's also a good choice for classic car owners. You can receive a multi-car discount if you insure a.

How To Invest In Mutual

How to invest in Mutual Funds? · Step #1: Find the type of fund that's right for you. TD offers a variety of mutual funds designed to help meet your investing. Investing in mutual funds can help you save and grow your money for the things that are important to you. Consider when you will need the money and how much. Access a variety of choices, funds from established providers, and research tools to help you find mutual funds that are right for you. A mutual fund is an investment portfolio consisting of stocks, bonds and other securities. · Mutual funds offer small and individual investors access to a well-. AFFORDABILITY To invest in a diversified portfolio of individual securities would require a large investment. Many mutual funds allow investors to purchase. A mutual fund is an investment company that pools money from many investors and invests the combined holdings in a single portfolio of securities including. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined. Invest in Mutual Funds Online. Mutual Funds are a smart way to grow your money. They can help you achieve your financial goals as they have the potential to. Mutual funds. Pool your money with the money of other investors to purchase tens or hundreds of different stocks, bonds or other investments. As the fund's. How to invest in Mutual Funds? · Step #1: Find the type of fund that's right for you. TD offers a variety of mutual funds designed to help meet your investing. Investing in mutual funds can help you save and grow your money for the things that are important to you. Consider when you will need the money and how much. Access a variety of choices, funds from established providers, and research tools to help you find mutual funds that are right for you. A mutual fund is an investment portfolio consisting of stocks, bonds and other securities. · Mutual funds offer small and individual investors access to a well-. AFFORDABILITY To invest in a diversified portfolio of individual securities would require a large investment. Many mutual funds allow investors to purchase. A mutual fund is an investment company that pools money from many investors and invests the combined holdings in a single portfolio of securities including. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined. Invest in Mutual Funds Online. Mutual Funds are a smart way to grow your money. They can help you achieve your financial goals as they have the potential to. Mutual funds. Pool your money with the money of other investors to purchase tens or hundreds of different stocks, bonds or other investments. As the fund's.

This brochure explains the basics of mutual fund and ETF investing, how each investment option works, the potential costs associated with each option, and how. Mutual funds let investors pool their money together to buy stocks, bonds and other investments "mutually” to earn income or invest in long-term growth. Use the Top 25 Mutual Funds, on MarketWatch, to compare mutual funds How to Invest · MarketBrief · Fire Starters · How Bad Is It · The Cost of Things. If you wish to invest online through HDFC Bank, you will need to have an ISA. Investing through an ISA is simple. Just log into your account, select the scheme. A mutual fund consists of a portfolio of stocks, bonds, or other securities and is overseen by a professional fund manager. What are the different types of mutual funds I can invest in? · Equity Funds · Fixed Income Funds · Money Market Funds · Balanced Funds · Target Date Funds · Index. Find a professionally managed mutual fund. U.S. News has ranked more than mutual funds. Rankings that combine expert analyst opinions and fund-level. Lastly, since you mention wanting to invest every month, you may want to check out our Recurring Investments, which can help you set your. Invest in Mutual Fund Online in India with ICICI Bank and grow your wealth with 13+ investment options. Explore experts' recommended funds with NAV history. Learn how to invest in a mutual fund and open your account quickly and easily online. A common type of investment company, mutual funds are open-end funds, meaning that investors can purchase and redeem shares in the funds on a daily basis based. Investing in mutual funds with J.P. Morgan. Access thousands of different securities through mutual funds from a variety of public companies. Use Self-Directed. Before investing in a mutual fund scheme, whether through online mode or via conventional paper based mode, one must first complete the KYC process by filling. Investors should know that you can invest in mutual funds only from your own bank account through cheque or online banking. You can also invest in cash but only. Mutual funds offer an affordable way to invest in a wide array of stocks without paying transaction fees for each stock held. Management. One can invest in Mutual Funds by submitting a duly completed application form along with a cheque or bank draft at the branch office or designated Investor. Mutual Funds Investment - Invest in best mutual funds in India with HDFC Bank. Mutual funds are funds that pool the money of several investors to invest in. A mutual fund is a company that makes investments for people who share common financial goals. This allows a group of investors to pool their assets in a. Mutual funds allow you to buy and sell shares as well as convert your assets to cash with ease. View Nuveen mutual funds' performance. Investment. Mutual funds make for a simple and efficient way to diversify your portfolio. E*TRADE offers thousands of leading mutual funds to choose from.

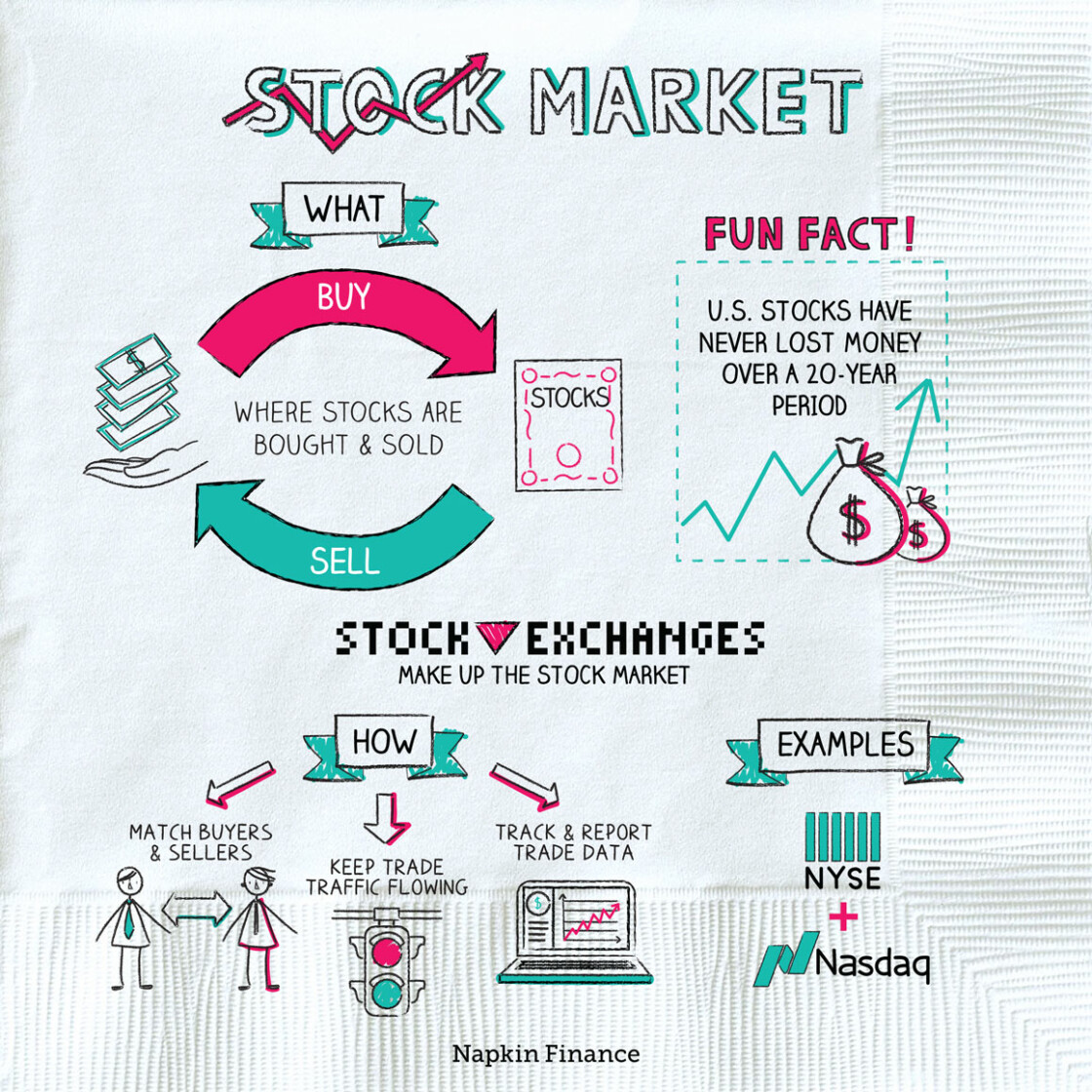

The Stock Market Explained For Dummies

In exchange for the money it receives from investors, companies issue shares, or stock, to investors. The initial stock price is set prior to the IPO. Investors. To enter the share market as a trader or an investor, you must open a demat or a brokerage account. Without a demat account, you cannot trade in the stock. The stock market is a trading network that connects investors looking to buy and sell stocks and their derivatives. An easy way to think about think about the. People aim to make money from investing in shares through one, or both, of the following ways: An increase in share price. Usually known as 'capital growth' or. If the price of your first stock is overvalued or outside your target range, there may be other opportunities to invest in similar companies that have more. The world's stock markets are complex, but are all based upon one simple concept Connecting stock buyers with stock sellers to trade under an agreed upon set. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. For example, let's say a stock is trading at $50 a share. You borrow shares and sell them for $5, The price subsequently declines to $25 a share, at. The bestselling Stock Investing For Dummies is full of practical and realistic stock market guidance. Today's market is full of surprises, and this book. In exchange for the money it receives from investors, companies issue shares, or stock, to investors. The initial stock price is set prior to the IPO. Investors. To enter the share market as a trader or an investor, you must open a demat or a brokerage account. Without a demat account, you cannot trade in the stock. The stock market is a trading network that connects investors looking to buy and sell stocks and their derivatives. An easy way to think about think about the. People aim to make money from investing in shares through one, or both, of the following ways: An increase in share price. Usually known as 'capital growth' or. If the price of your first stock is overvalued or outside your target range, there may be other opportunities to invest in similar companies that have more. The world's stock markets are complex, but are all based upon one simple concept Connecting stock buyers with stock sellers to trade under an agreed upon set. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. For example, let's say a stock is trading at $50 a share. You borrow shares and sell them for $5, The price subsequently declines to $25 a share, at. The bestselling Stock Investing For Dummies is full of practical and realistic stock market guidance. Today's market is full of surprises, and this book.

The U.S. market makes up only a portion of the world's opportunities for bond investing. Invest internationally. What's next. The stock market works by pairing buyers and sellers, who want to trade financial securities, and helping facilitate transactions. Or, in other words, a stock. Just like stocks, you can trade ETFs on a stock exchange at any point during market hours. Whether you're an individual looking to invest, or a seasoned. One of the popular investment options is stocks. When you invest in stocks, you become a shareholder and can benefit from the company's profits and growth. Trading For Dummies is for investors in search of a clear guide to trading stocks in any type of market. Inside, you'll get sample stock charts, position. Consider Warren Buffett's advice: "Never invest in a business you cannot understand." Think about the companies that provide the products and services you, your. To enter the share market as a trader or an investor, you must open a demat or a brokerage account. Without a demat account, you cannot trade in the stock. Stock market exchanges act as both primary and secondary markets for a company's stock. They allow companies to directly sell shares via initial public. People aim to make money from investing in shares through one, or both, of the following ways: An increase in share price. Usually known as 'capital growth' or. Exchanges, whether stock markets or derivatives exchanges, started as physical places where trading took place. Some of the best known include the New York. A stock exchange, or stock market, is a system for buying and selling securities, or stocks and bonds. Trading is buying and selling investments, such as stocks, bonds, commodities, and other types of assets, with the goal of making a profit. Trading is speculating on an underlying asset's market price movement without owning it. So, basically, trading means that you're only predicting whether a. A stock is "public" when its company lists it on major exchanges, like the New York Stock Exchange (NYSE) or Nasdaq. This enables everyday investors to buy and. Stock exchanges are secondary markets, meaning existing shareholders make transactions with potential buyers. When you purchase a share, you're not buying it. Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks also are called “equities.”. Growth-style funds - Growth funds focus on future gains. A growth fund manager will typically invest in stocks with earnings that outperform the current market. Financial markets facilitate the interaction between those who need capital with those who have capital to invest. In addition to making it possible to raise. As economist Leopoldo Abadía explains in his informative essay 'Economics for dummies shares on a regulated market, i.e. "a stock exchange." From then. A stock represents an ownership stake in a company as a common shareholder. Common stocks allow shareholders to vote on company issues, with most companies.

Highest Current Jumbo Cd Rates

Jumbo Certificate Rates ; 24 to 35 Months, %, % ; 12 to 23 Months, %, % ; 6 to 11 Months, %, % ; 3 to 5 Months, %, %. Best jumbo CD rates for months ; 18 months, Navy Federal Credit Union, % ; 2 years, Suncoast Federal Credit Union, % ; 2 years, Credit One Bank, %. Best jumbo CD rates September ; My eBanc Jumbo Online Time Deposit · % to % · 6 months to 36 months ; State Bank of Texas Jumbo certificates of deposit. If the checking account is closed for any reason or the eligible savings account or CD is de-linked, the account will revert to the then-current applicable. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. With a Certificate of Deposit account you know exactly what interest rate you'll receive on your CDs during their term. Book your Chase CD account today! The highest year CD rate today is % from First National Bank of America. Current news on CD rates. CD rates have skyrocketed over. Currently, the minimum is $2, and the maximum is $, per account. What fees does Live Oak charge for CDs? Account Fees. The highest yielding rate from the State Department FCU is % on its and month terms. You can still earn good yields on its , and month. Jumbo Certificate Rates ; 24 to 35 Months, %, % ; 12 to 23 Months, %, % ; 6 to 11 Months, %, % ; 3 to 5 Months, %, %. Best jumbo CD rates for months ; 18 months, Navy Federal Credit Union, % ; 2 years, Suncoast Federal Credit Union, % ; 2 years, Credit One Bank, %. Best jumbo CD rates September ; My eBanc Jumbo Online Time Deposit · % to % · 6 months to 36 months ; State Bank of Texas Jumbo certificates of deposit. If the checking account is closed for any reason or the eligible savings account or CD is de-linked, the account will revert to the then-current applicable. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. With a Certificate of Deposit account you know exactly what interest rate you'll receive on your CDs during their term. Book your Chase CD account today! The highest year CD rate today is % from First National Bank of America. Current news on CD rates. CD rates have skyrocketed over. Currently, the minimum is $2, and the maximum is $, per account. What fees does Live Oak charge for CDs? Account Fees. The highest yielding rate from the State Department FCU is % on its and month terms. You can still earn good yields on its , and month.

Mid America Bank currently offers the best 1-year Jumbo CD, with an APY of %, one of the best on the market regardless of CD type. As expected for Jumbo. Jumbo CDs that are issued by FDIC-member banks are fully guaranteed up to $,, based on your total deposits at any one institution. So, a certificate of. For those who have a large sum to deposit, today's best jumbo CD rate from a nationally available institution is % APY, offered by My eBanc for a. Best jumbo CD rates September ; My eBanc Jumbo Online Time Deposit · % to % · 6 months to 36 months ; State Bank of Texas Jumbo certificates of deposit. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. Best 1-year CD rates. The highest 1-year CD rate today is % from Merchants Bank of Indiana. Best month CD rates. The highest month CD rate today is. A certificate of deposit (CD) is a type of savings tool with various benefits. Explore current CD rates and how to purchase CDs through Schwab. The maximum amount you may deposit is $1,, The APY assumes that interest remains on deposit until maturity. Fees or a withdrawal of interest will reduce. Compare All CD Accounts on Raisin ; Mission Valley Bank · % ; Ponce Bank · % ; Dayspring Bank · % ; Ponce Bank · % ; United Republic Bank · %. Rates on shortish CDs range from % APY on the three-month CD to % APY on the month CD. First IB has a lot of medium- to longer-term CDs as well, with. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Current Rates: ; 60 Months, %, % ; APY (Annual Percentage Yield) is accurate as of May 1, and is subject to change at any time. Fees could reduce the. Find a U.S. Bank CD (certificate of deposit) that best suits your investing needs, with the CD rate and term that is right for you. Apply now. Current Rates: ; 60 Months, %, % ; APY (Annual Percentage Yield) is accurate as of May 1, and is subject to change at any time. Fees could reduce the. CIT Bank offers 2, 3, 4 & 5-Year Jumbo CDs designed to help you maximize your personal finances. View our rates. Member FDIC. For a limited-time only, get a 3-month Jumbo CD with an amazing rate of % APY*. Available at any Broadway Bank financial center today. Find a Financial. FDIC-Insured Certificates of Deposit Rates ; month, N/A ; 3-year, % ; 4-year, % ; 5-year, %. Learn about TD Bank's Choice Promotional CD, a tiered interest certificate of deposit with higher rates for longer terms and when you have an eligible TD. Best 1-year CD · Alliant Credit Union: Month Jumbo CD - % APY · Freedom Bank: Month High-Yield CD - % APY · American First Credit Union: Month. For a limited-time only, get a 3-month Jumbo CD with an amazing rate of % APY*. Available at any Broadway Bank financial center today. Find a Financial.

Is Ford A Good Investment Right Now

ford and GM are like intel and amd, sotimes they slump a few generations, but in the end they are leaders of industry. higher car prices wont go away with more. Ford is the second-largest U.S.-based automaker, behind General Motors, and the sixth-largest in the world, behind Toyota, Volkswagen Group, Hyundai Motor Group. Ford holds several negative signals and we believe that it will still perform weakly in the next couple of days or weeks. We, therefore, hold a negative. Price-To-Earnings ratio (10x) is below the US market (17x) Earnings are forecast to grow 16% per year Trading at good value compared to peers and industry Ford. Ford stock has delivered pleasant returns; its 16% year-to-date uptick is better than any publicly traded US automaker, and best of the five most valuable. Looks like there's nothing to report right now. Reload · Technicals. Summarizing what the indicators are suggesting. Neutral. SellBuy. Strong sellStrong buy. stock outperforms competitors on strong trading day. Aug. 22, at p.m. Stock Now? Aug. 22, at a.m. ET on searchconsole.ru Analysts Offer. It has overperformed other stocks in the Auto Manufacturers industry by percentage points. Ford Motor Co stock is currently +% from its week low of. Is Ford Motor stock a Buy, Sell or Hold? Ford Motor stock has received a consensus rating of buy. The average rating score is and is based on 28 buy ratings. ford and GM are like intel and amd, sotimes they slump a few generations, but in the end they are leaders of industry. higher car prices wont go away with more. Ford is the second-largest U.S.-based automaker, behind General Motors, and the sixth-largest in the world, behind Toyota, Volkswagen Group, Hyundai Motor Group. Ford holds several negative signals and we believe that it will still perform weakly in the next couple of days or weeks. We, therefore, hold a negative. Price-To-Earnings ratio (10x) is below the US market (17x) Earnings are forecast to grow 16% per year Trading at good value compared to peers and industry Ford. Ford stock has delivered pleasant returns; its 16% year-to-date uptick is better than any publicly traded US automaker, and best of the five most valuable. Looks like there's nothing to report right now. Reload · Technicals. Summarizing what the indicators are suggesting. Neutral. SellBuy. Strong sellStrong buy. stock outperforms competitors on strong trading day. Aug. 22, at p.m. Stock Now? Aug. 22, at a.m. ET on searchconsole.ru Analysts Offer. It has overperformed other stocks in the Auto Manufacturers industry by percentage points. Ford Motor Co stock is currently +% from its week low of. Is Ford Motor stock a Buy, Sell or Hold? Ford Motor stock has received a consensus rating of buy. The average rating score is and is based on 28 buy ratings.

Is Ford a good stock to buy? “Owning auto stocks before a recession is often painful, but we feel that a recession sell off creates excellent buying. There is currently 1 sell rating, 7 hold ratings and 4 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors. Unfortunately, the markets have proved hesitant to invest in the iconic Detroit automaker despite its rebound from the Great Recession and the record profits. In the last year, 15 stock analysts published opinions about F-N. 4 analysts recommended to BUY the stock. 6 analysts recommended to SELL the stock. The latest. Best Analysts Covering Ford Motor trades and holding each position for 1 Month would result in % of your transactions generating a profit, with an. Is Ford Motor stock A Buy? Ford holds several negative signals and we believe that it will still perform weakly in the next couple of days or weeks. We. Ford: EV Growth Slowdown Is Good. Feb 15 · Ford Motor's (NYSE:F) Earnings May Ford: No Reason To Buy Right Now. Aug Ford Appoints Peter Stern as. Taking into account the day investment horizon and your above-average risk tolerance, our recommendation regarding Ford Motor is 'Strong Hold'. The stock right now is down so it would be a good time to buy. The P How does Ford Motor Company look as an investment prospect right now? Currently, Ford has a market capitalization of $ billion. Its top shareholders, with % of the outstanding shares, are institutional. Latest On Ford Motor Co. ALL CNBC INVESTING CLUB PRO. Why Ford believes its $ billion shift in EV strategy is the right Now. Get this delivered to your. Calculate Investment. Dividend History. Select Year: , , , , Ford shareholders were instructed to allocate % of their basis in Ford. Ford Motor has received a consensus rating of Hold. The company's average rating score is , and is based on 4 buy ratings, 7 hold ratings, and 1 sell. If you are looking for an investment with an attractive yield, check out Ford Motor Credit Company's Ford Interest Advantage Floating Rate Demand Notes. We. View the real-time F price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. The Ford Next segment is involved in the expenses and investments for emerging business initiatives aimed at creating value for Ford in vehicle-adjacent. Looking at the Growth Grade breakdown above, both Ford Motor Co and General Motors Co have a grade of B. For investors who focus solely on a company's upward. Long-Term Investment Oppurtunity?While vehicle manufacturing may not be the most stable industry, it is consistent. Ford has been in the game the longest and. Is Ford a good stock to buy? “Owning auto stocks before a recession is often painful, but we feel that a recession sell off creates excellent buying. Ford's Q4 earnings surpassed estimates, and the company expects adjusted EBIT in the range of $$12 billion for full-year This positive financial.

Best Company To Open Roth Ira With

What kind of IRA best suits my needs? Traditional IRA or Roth IRA? · Traditional vs. Roth IRA comparison chart · You can set up an IRA with a: bank or other. Find an Investing Option Best for You · GuideStone Traditional IRA · GuideStone Roth IRA. A Roth IRA can be a powerful way to save for retirement as potential earnings grow tax-free. Get Started at Fidelity. Plan for retirement with IRAs. Explore IRA opportunities with USAA's trusted partner Charles Schwab and save for your future. Start building your nest egg. S&P index funds are popular choices. “By doing the S&P, you're getting a piece of all companies (in the index),” said Myles Clements, a certified. A Roth IRA can be a good option for you if you value flexibility now and in retirement. Tax savings. Investments grow tax-free and your withdrawals are tax-free. Charles Schwab, Fidelity, Vanguard, TD Ameritrade, and E*Trade from Morgan Stanley each offer Roth IRAs and their application processes are fairly similar. Roth. When deciding whether to open an IRA or a brokerage account, be sure to do your research on companies and their fees. Learn More About IRA Options. Contact. Open a Schwab Roth IRA, with key advantages like tax-free growth potential for earnings and contributions, and qualified withdrawals that can be taken. What kind of IRA best suits my needs? Traditional IRA or Roth IRA? · Traditional vs. Roth IRA comparison chart · You can set up an IRA with a: bank or other. Find an Investing Option Best for You · GuideStone Traditional IRA · GuideStone Roth IRA. A Roth IRA can be a powerful way to save for retirement as potential earnings grow tax-free. Get Started at Fidelity. Plan for retirement with IRAs. Explore IRA opportunities with USAA's trusted partner Charles Schwab and save for your future. Start building your nest egg. S&P index funds are popular choices. “By doing the S&P, you're getting a piece of all companies (in the index),” said Myles Clements, a certified. A Roth IRA can be a good option for you if you value flexibility now and in retirement. Tax savings. Investments grow tax-free and your withdrawals are tax-free. Charles Schwab, Fidelity, Vanguard, TD Ameritrade, and E*Trade from Morgan Stanley each offer Roth IRAs and their application processes are fairly similar. Roth. When deciding whether to open an IRA or a brokerage account, be sure to do your research on companies and their fees. Learn More About IRA Options. Contact. Open a Schwab Roth IRA, with key advantages like tax-free growth potential for earnings and contributions, and qualified withdrawals that can be taken.

Roth IRAs with J.P. Morgan · Our J.P. Morgan Advisors and online investing tools can help you prioritize your long-term investing and retirement goals. · Open. Open a Schwab Roth IRA, with key advantages like tax-free growth potential for earnings and contributions, and qualified withdrawals that can be taken. searchconsole.ru provides a FREE Roth IRA calculator and other k calculators to help consumers determine the best option for retirement savings. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today. The 10 best Roth IRAs · Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA. Opening a Roth IRA with Fifth Third Securities will help you stay on track for retirement. Learn about Roth IRA limits and eligibility here! Both Roth IRAs and mutual funds have distinct tax implications: To start, contributions to Roth IRAs are made with after-tax income and have no required minimum. Roth IRAs with J.P. Morgan · Our J.P. Morgan Advisors and online investing tools can help you prioritize your long-term investing and retirement goals. · Open. A Comerica traditional IRA is a good choice for those who can't contribute to a work-sponsored retirement plan and includes competitively priced CDs to help. Use the powerful retirement savings tool known as a Roth IRA to help you start building funds for your future. Open a Roth IRA. Overview. Enjoy peace of mind. Popular providers of do-it-yourself Roth IRA accounts include Fidelity, Vanguard and Ally Invest. 1. S&P index funds. One of the best places to begin investing your Roth IRA is with a fund based on the Standard & Poor's Index. Schwab offers multiple types of individual retirement accounts (IRAs) to help meet your retirement goals. Open an IRA account. Open a Roth IRA. You can open and fund a new IRA, including A SEP better accommodates fluctuations in cash flow for certain types of businesses. Open a Roth or Traditional IRA today. To discuss your investment options Top 5 questions about IRAs. Compare IRAs. The two most common types of IRAs. Best if you want: Fidelity offers a self-directed IRA at the largest provider of retirement accounts in the US with helpful customer support. Commissions: 0%. Savings IRAs from Bank of America and Investment IRAs from Merrill Edge® are available in both Traditional and Roth. Find the IRA that's right for you. A custodial Roth IRA for Kids can be opened and receive contributions for a minor with earned income for the year. · Roth IRAs provide the opportunity for tax-. Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. Company ("VNTC"), a. There are many good options. I've been satisfied with the major low cost investment companies (Vanguard, Schwab, Fidelity, etc.). They offer a.

Premium On Bonds

Premium vs. Discount Bonds. A premium bond often has a higher coupon rate than the existing credit quality rate and the bond's final maturity. In contrast, when. Under the proposed regulations, bond issuance premium is amortized as an offset to the issuer's otherwise allowable interest deduction, not as a separate item. A taxpayer pays a premium for a bond if the bond's purchase price is greater than its face value. The premium is the difference between the purchase price. A premium bond is a debt security that is traded in the secondary market over its par value or face value. A bond's higher interest rate than the market's. A premium bond is one which market value is greater than its face value. To understand why a bond trades above its par value – at a premium – it is helpful. Ready to see if you have won a prize? Enter your holder's number to check if you've won in this month's Premium Bonds draw. Good luck! A premium municipal bond is priced above par, or more than its face value, when its coupon rate – the interest paid to bondholders – is higher than the. You must be aged 16 or over and buying Bonds for yourself or for a child under You or the child must already have some Premium Bonds, and you must know your. Bond premium or premium on bonds occurs when the bond's actual interest payments are greater than the interest payments expected by the market. Premium vs. Discount Bonds. A premium bond often has a higher coupon rate than the existing credit quality rate and the bond's final maturity. In contrast, when. Under the proposed regulations, bond issuance premium is amortized as an offset to the issuer's otherwise allowable interest deduction, not as a separate item. A taxpayer pays a premium for a bond if the bond's purchase price is greater than its face value. The premium is the difference between the purchase price. A premium bond is a debt security that is traded in the secondary market over its par value or face value. A bond's higher interest rate than the market's. A premium bond is one which market value is greater than its face value. To understand why a bond trades above its par value – at a premium – it is helpful. Ready to see if you have won a prize? Enter your holder's number to check if you've won in this month's Premium Bonds draw. Good luck! A premium municipal bond is priced above par, or more than its face value, when its coupon rate – the interest paid to bondholders – is higher than the. You must be aged 16 or over and buying Bonds for yourself or for a child under You or the child must already have some Premium Bonds, and you must know your. Bond premium or premium on bonds occurs when the bond's actual interest payments are greater than the interest payments expected by the market.

We may issue multiple bonds to fill your order. The bonds may be of different denominations. We use $50, $, $, $, and $1, bonds. Again, the amount. Discounts will be amortized over the life of the bond. The amount amortized will increase the interest expense each period. Premium – Premium is the amount if. Similar to equity securities, corporate bonds often exhibit a new-issue premium (NIP), whereby the yield on the new issue is set at a level higher than that. Purchasing bonds at a price above or below the bond's maturity value can lead to unique tax consequences, but also provide investors some opportunity for tax. Premium bonds frequently offer good values and can be an attractive alternative to discount and par bonds. They can be appropriate for you if you're looking. A taxpayer pays a premium for a bond if the bond's purchase price is greater than its face value. The premium is the difference between the purchase price. Premium bonds are those that trade above their face value or initial price. In essence, these bonds have a future value that surpasses their. Understanding premium municipal bonds can be difficult for even the most seasoned investors. Munis are underwritten with a laundry list of complexities such. They receive cash for the fair value of the bond, and the positive (negative) difference (if any) is recorded as a premium (discount) on bonds payable. Carrying. The premium is necessary to compensate the bond purchaser for the above average risk being assumed. Bonds are issued at a discount when the coupon interest rate. An amortizable bond premium refers to the excess amount paid for a bond over its face value or par value. Over time, the amount of premium is amortized. Premium on bonds payable (or bond premium) occurs when bonds payable are issued for an amount greater than their face or maturity amount. A discussion of premium bonds requires defining three of the basic components of a bond: the par amount, the yield, and the coupon. The par amount is the stated. How do Premium Bonds work? · You'll need to invest at least £ · You can keep buying bonds until you reach the maximum holding level of £50, · You get a. Similar to equity securities, corporate bonds often exhibit a new-issue premium (NIP), whereby the yield on the new issue is set at a level higher than that. Key takeaways · The Federal Reserve has raised interest rates from historically low levels but may change that policy. · Premium bonds may be less sensitive to. The term bonds issued at a premium refers to newly issued debt that is sold at a price in excess of its par value. Premium Bonds are a form of investment bond. They are sold at a price higher than their face value, which we refer to as selling 'at a premium'. Premium Bonds. If the coupon rate is higher than market interest rates, for example, then the bond will likely trade at a premium. Financial Term. Bond A Bond B Bond C. Bond A. If a bond has a $1, face value and sells for $1, after interest rates drop, the unamortized bond premium ($90) is the difference between the selling price.